What is SIP:

SIP (Systematic Investment Plan) is a way to invest in Stocks or Mutual Funds periodically, over a period of time. You can choose to invest every month or every week. Full form of SIP is Systematic Investment Plan.SIP is the best way to invest in Stocks or Mutual Funds compared to the Lump sum investment, in which, you invest the entire corpus in one go. Whereas, in SIP you are disciplined enough and invest a fraction of your corpus every month or week. There are many Benefits of investing via SIP route compared to Lump sum investment.

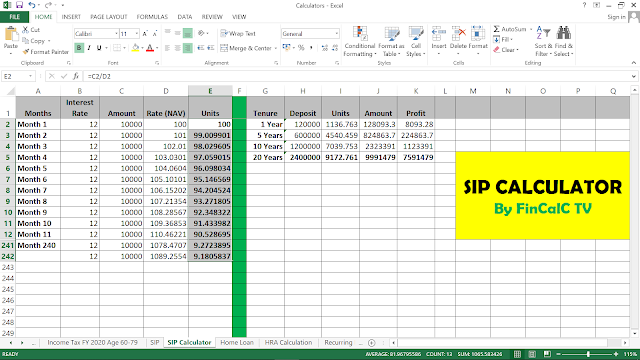

SIP Returns Excel Calculator Video:

Watch this video to see how SIP returns are calculated when you invest in Stocks or Mutual Funds for a period of time:

WATCH: All Excel Calculators Videos

As you can see in the video, we have taken 12% annual rate of return, and calculated SIP returns that you can expect for 1 year, 5 years, 10 years and 20 years. You can also choose to invest via SIP for lifetime if you want to get rich!

Benefits of SIP (Systematic Investment Plan):

- Allows you to invest only a fraction of amount instead of entire corpus in one go. You can choose this fraction of amount as SIP based on your affordability

- Rupee Cost Averaging. You buy more units when market goes down, since NAV is less (more on this below). This increases your returns when market comes back to normal

- You can have multiple SIPs based on your goals whether they are short term, medium term or long term goals

- SIPs are flexible these days. You can choose to pause a SIP for few weeks or months, or stop SIP if your goal is achieved before time

- You become disciplined in working towards goals with given timelines

You may also Like: [VIDEO] PPF Excel Calculator | Public Provident Fund Calculator | PPF Interest Calculation

How Returns are calculated in SIP:

You must have heard about NAV (Net Asset Value) of a Stock or Mutual Fund.

If not, NAV or Net Asset Value is the price of a unit of Stock or Mutual Fund. That means, it is the value of per share or a unit in Stock or Mutual Fund.

Let's say NAV of a Mutual Fund is Rs. 100.

This means the price of 1 unit of this Mutual Fund is Rs. 100.

If you invest Rs. 100 in this Mutual Fund, you get 1 Unit of this Mutual Fund in your Investment Account

If you invest Rs. 1000, you get 10 Units.

If you invest Rs. 10,000, you get 100 Units and so on.

This way you accumulate Stocks or Mutual Funds Units in your Investment Account.

SIP vs Lumpsum Returns:

Formula:

Units = Amount divided by NAV

In similar way, in SIP, you invest every month, and you accumulate Units based on the NAV of Stocks or Mutual Funds on that Day.

Here are some Screenshots of Units Accumulated over period of time:

Total Units Accumulated = 10,448.82 over a period of 20 Years

|

| Units accumulated with Rate of Return = 12% |

Rate of Return = 12%

Total Units Accumulated = 9172.761 over a period of 20 Years

|

| Units accumulated with Rate of Return = 15% |

Rate of Return = 15%

Total Units Accumulated = 7689.156 over a period of 20 Years

As seen above, with increase in expected Rate of Return, the NAV increases and the total units you can accumulate decreases. Total Units accumulation are inversely proportional to NAV.

Here's another video explaining 10 years, 5 years and 1 year SIP returns (Systematic Investment Planning) for a particular mutual fund as example. Watch full video to check SIP returns of this fund

SIP returns Calculator for Mutual Fund:

WATCH: All Excel Calculators Videos

Love Reading Books? Here are some of the Best Books you can Read: (WITH LINKS)

How you can maximize SIP Returns:

One cannot time the market to take the advantage of ups and downs.

Theoretically, it is seen that you should buy low and sell high in order to get maximum returns, but can you predict those ups and downs in market? You cannot.

If it was easy to time the market, people would be busy making money in markets instead of explaining you how to make money online or how SIP works!

History has taught us that the dead (or inactive) accounts who don't panic buy or panic sell based on their emotions related to market ups and downs have got the advantage over active accounts.

People with active accounts try to be smart and time the market. But they lose in long run.

Only 0.1% people would be able to time the market only 0.1% times based on their luck.

- So the best way to get maximum profit is to continue with SIP over longer run

- Don't panic buy or panic sell based on emotions

- Don't try to time the market

- Start investing and forget about it

- Invest in low cost Funds

How to choose from several Mutual Funds:

Every Mutual Fund has Expense Ratio related to it. This is the fees that AMC (Asset Management Company) takes in order to manage your funds.

You should choose the Mutual Fund that has low Expense Ratio.

Low expense Ratio means you have to pay low fees on your Assets under Management.

Speaking of Low expense Ratio, Index Funds are the type of Mutual Funds having Low Expense Ratio, thus Low fees.

So the secret to maximize your returns in Mutual Funds is to start SIP in low fees funds, such as Index Funds, and to start investing and forget about it until you reach 60 or more.

Here's another video of how SIP returns are calculated for a particular Mutual Fund in past 1 year:

WATCH: All Excel Calculators Videos

Some more videos to Watch:

___

I'd love to hear from you if you have any queries about Personal Finance and Money Management.

Download our Free Android App - FinCalC to Calculate Income Tax and Interest money on Savings Account.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.

___

I'd love to hear from you if you have any queries about Personal Finance and Money Management.

Download our Free Android App - FinCalC to Calculate Income Tax and Interest money on Savings Account.

Follow the Blog and Subscribe to YouTube Channel to stay updated about Personal Finance and Money Management topics.

___

9 Comments

The information your share is very useful to me and many people are looking for them just like me! Thanks for your sharing! and I find it very helpful

ReplyDeleteEcwon

Live Casino Games The Real Treasure Of Thrills

With ecwon enjoy live online casino

Play ECWON Online Betting Malaysia

Why betting casino games are entertaining?

How to win the betting games in a casino?

Thanks for your personal marvelous posting ! I truly enjoyed

ReplyDeleteWhy select ECWONSG Singapore Online Casino for playing?

Ecwonsg2 the Best Option to Visit & Play Online Gambling Games

ECWON Design User-Friendly Online Gambling Games

How Earn Money from Live Casino Games

Live games and online betting at Ecwonsg casino

Latest Updates in casino sites

Ecwonsg2

What an amazing post you have. Very Informative. Also, check out my official website:-

ReplyDeletePayment Solution

Online Payment Gateway

Online Payment Service

Hello all , such a amazing informative post that you share in this article and guys if you can interested the online casino play game for the entertainment so plz you can join us:-

ReplyDeleteOnline Casino Malaysia

grand dragon casino

sbobet

Good Blog.Credit scores are the carte de visite for both, the small businesses or for the well-established businesses. Getting a proper loan for a startup or a new venture is a task in itself. And, if it is accompanied by a poor credit history or low credit scores, then the task becomes even more difficult. Most banks do not prefer to provide start up business loans for new ventures. So, it becomes a herculean task to get bad credit business loans from them.Is having a poor credit score stopping you from starting your own business? Avail business loans

ReplyDeleteFrom Mr Pedro, Mr Pedro is a loan officer who works with a USA loan company and they offer international loans at 2% annual return. Here is Mr Pedro email contact pedroloanss@gmail.com and start your new venture.

Finance Companies in UAE

ReplyDeleteLooking For Investors in UAE

Finance Companies in Dubai

Investment Companies in UAE

Asset Management Companies in UAE

Thank for sharing!

ReplyDeleteAstral city

I like your blog that you provide us. You can follow us by these links...

ReplyDelete918kiss apk

918kiss free kredit

918kiss singapore

Nice blog Thank you. You can follow us by these links...

ReplyDeleteSlot Game Malaysia

XE88 Malaysia

XE88 Download